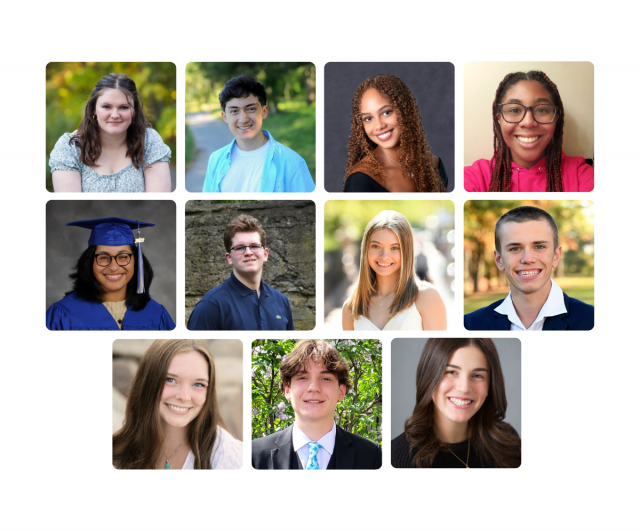

You’re In! Now Let’s Talk About Paying for College

You’re heading to college—congratulations! Getting accepted is a huge achievement, and we know how much effort, time, and dedication it takes to get here.

As fall approaches, however, it’s time to start planning for what comes next…especially how to pay for it all.

Financing College: What Comes After Financial Aid?

After reviewing your financial aid package, you might notice a few remaining costs—but don’t worry, there are smart solutions to help you cover the gap.

Federal loans are often the first stop students make for additional funding. They offer fixed interest rates and flexible repayment options:

- Direct Subsidized Loans: For students with financial need. The government pays the interest while you're in school.

- Direct Unsubsidized Loans: Available to all students, regardless of financial need. Interest accrues while you're in school.

- Direct PLUS Loans: For parents of undergraduate students or for graduate/professional students. These loans may have higher interest rates and fees.

Private Student Loans & Lines of Credit

If you need a little extra support beyond federal aid, private student loans or a student line of credit can help fill the gap. These are offered by banks and credit unions and can be tailored to your specific needs.

A private student loan is a one-time amount of money you borrow to pay for school, which you repay with interest after you graduate. To get a loan for every school year or semester, you need to reapply.

A student line of credit is a flexible option that makes borrowing easy. Here’s why it might be a smart choice:

- Apply once and access funds as needed each academic year

- Flexible in-school repayment options

- Lower interest rates than many private loans or credit cards, with no fees

- Build credit responsibly while still in school

- Personalized support from local lenders like Metro Credit Union

Plus, with Metro’s student line of credit1, you don’t have to reapply every year!

Managing Personal Finances While at School

College may be the first time you’re managing money on your own. That’s why it’s important to make sure your bank account works wherever you’re headed, especially if you’re moving out of state or studying abroad.

- Set a Budget & Track Spending: Create a monthly budget for essentials (tuition, rent, food) and use apps or spreadsheets to monitor expenses.

- Manage Bank Accounts & Income: Open student-friendly checking/savings accounts, set up direct deposit, and explore part-time or freelance work.

- Build Credit & Save Smartly: Use credit responsibly, start an emergency fund, and consider learning about basic investing.

- Use Discounts & Spend Wisely: Take advantage of student deals, buy used textbooks, cook at home, and avoid unnecessary subscriptions.

Metro Credit Union offers a student-friendly checking account2 designed with you in mind, with features that help you avoid unnecessary fees and stay in control of your finances—no matter where college takes you. Plus, the Metro iBanking app can help you create and track your budget!

Saving Now & Earning on Campus

Starting a summer job? Now is the perfect time to also start saving. Even setting aside $10–$20 a week can make a big difference when the semester begins.

College life comes with exciting opportunities—and a few surprise expenses. A savings account helps you stay ready for both, giving you a financial cushion for the semester ahead.

Many colleges offer flexible, student-friendly jobs that allow students to earn money while balancing their academic responsibilities. Common roles include:

- Dining hall staff

- Resident assistants (RAs) that come with added perks like free housing

- Tutors

- Front desk workers

- On-campus or local internships

Be sure to check with your school’s student employment office to explore what’s available.

Ready to Take the Next Step?

Whether you’re gearing up for your first semester or helping your child take this exciting next step, Metro Credit Union is here to support you. From flexible student lending options to everyday banking tools, we’re committed to helping you make smart financial choices for college and beyond.